META Q4'2024 Earnings

Knock out quarter, but a heavy "Trust Zuck" year ahead

Q4 and 2024 Overall was Fantastic

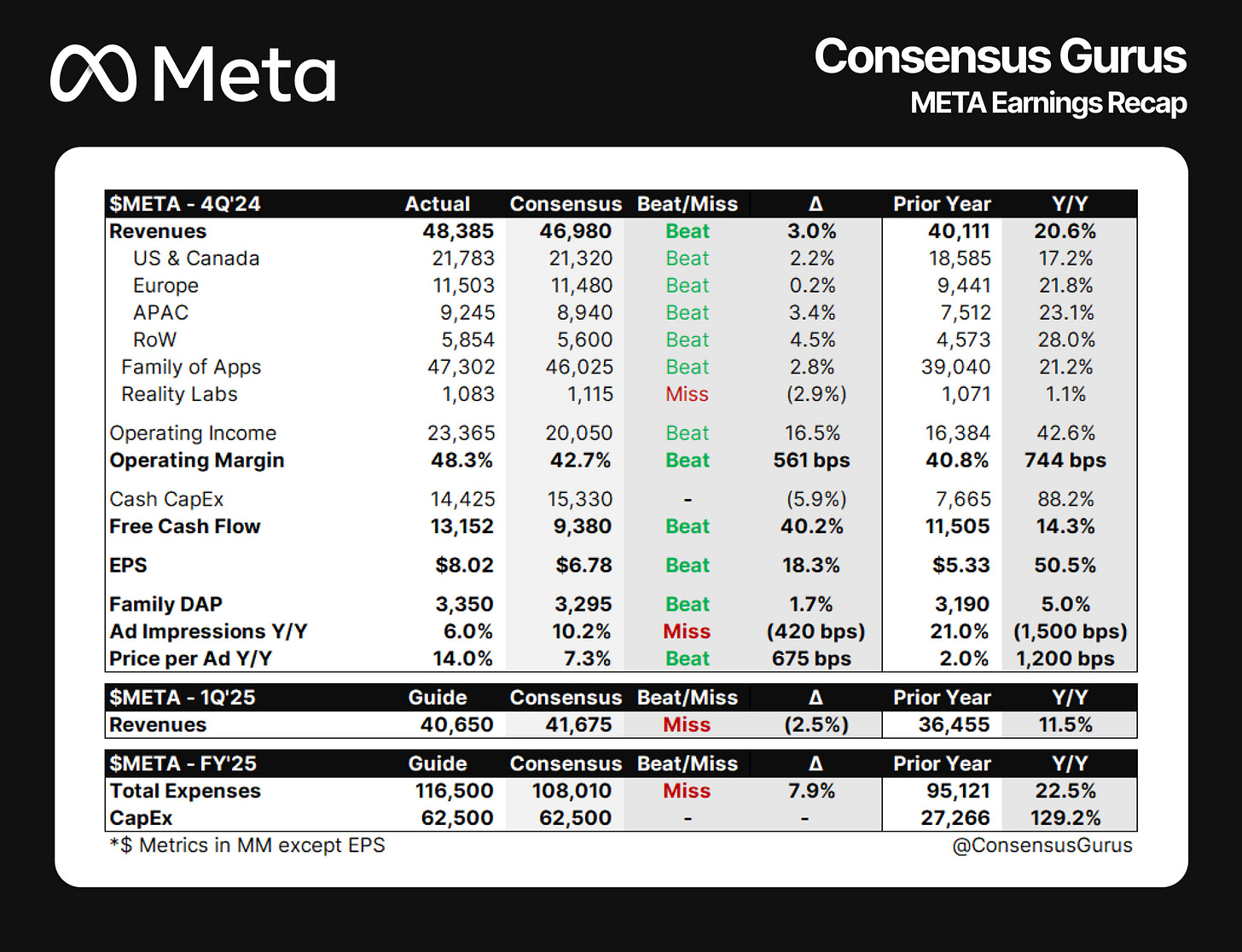

Meta’s earnings were gorgeous coming out of Q4’2024. With sizable beats on the top and bottom lines.

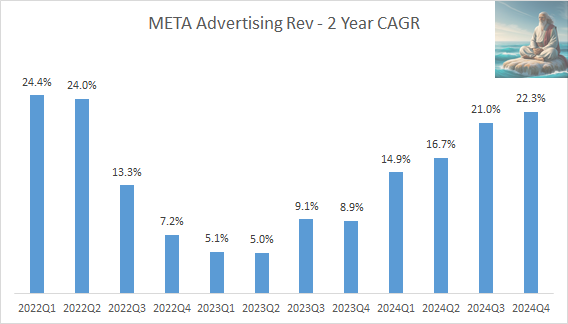

Revenue growth continues to accelerate on a 2 year stack basis. Driven by Asia and RoW out performance primarily through increasing monetization. Family Average Revenue per Person reached an all time high of $14.25 up 16% year on year.

Expense control drove an amazing 88% incremental margin, delivering an overall 60% operating income margin for Family of Apps (blue Facebook, Instagram, and WhatsApp). This was materially ahead of street expectations driving a 5.5 percentage point beat in operating margin.

The stock price reflects the expansion with a return to headline average P/E NTM

Unfortunately, with the global political ad spend cycle behind us1, run-rate “year of efficiency” gains in the rear view mirror, and a rising US dollar. 2025 improvements will be on rather difficult comparisons but importantly still rising on an absolute basis.

Summary:

EPS (Adj) Street expectations for 2025 is 25.24 i.e. 6% growth on 14-15% revenue growth. This will put pressure on the share price as the multiple comes into question.

A bet on Meta over the next 2 years is a bet on some combination of the following:

Capex: Core AI and Gen AI will produce good returns. The few analysts who forecast such things have Return on Assets on a downward decline over the next 3 years with a ~4.5 pp decline to 20%

We can already see hints of the returns on Core AI as monetization rates continues to outperform the rest of the market growing per person monetization by 16% vs 6% PINS 0.00%↑, 5% SNAP 0.00%↑

Gen AI capex returns will be reliant on new products coming out this year in the form of Meta AI Studio, Meta Ray Ban integration improvements, and

Reality Labs lost $17.7 billion this year, and Meta has told us to expect this to go to $19 billion this year. Applying the current 27.9x multiple to this loss accounts for $450 billion reduction in market value, or ~25% of the company. It is my belief that this is the final push. The division either

Succeeds resetting the narrative and associated multiple placed on the losses (as well as possibly beating guidance losses) or;

The division goes through a major restructuring with a major budget adjustment (still loss making).

2025 is a “Trust Zuck” Year

There have been periods in the past where any thesis on Meta had a large component of trusting Mark Zuckerberg (MZ) to maintain a legacy of excellence. From the IPO year where they had no monetization on mobile and had just spent $1 billion on a 13-person startup with no revenue called Instagram2 to the Q4’22 share price collapse when Apple broke iOS monetization and TikTok was hoovering up creators and engagement.

This year will be similar with a combination of increasing losses into Reality Labs, massive increases in capital expenditure across the server portfolio, and a drop in margins.

Reality Labs

We’re already trusting him on Reality Labs with a cumulative loss of over $60 billion. This year was called out as increasing the loss rate:

"We do anticipate that operating losses in Reality Labs will increase in 2025 as they did in 2024"3

— MZ on Q4’24 earnings call

Within Reality Labs, both Wearables (Meta Ray-Bans) and Metaverse are getting equal love.

So, broadly speaking, we think our Reality Labs investments are kind of spread across two categories; Metaverse, which includes the VR, MR, and social platform initiatives. And Wearables, which includes our AR and AI glasses work, and we expect in 2025 that roughly half of our Reality Labs investment will be across the Wearables initiatives and the remaining half on Metaverse.

— Susan Li, Meta CFO on Q4’24 follow up earnings call

However, it is wearables that are driving the increased spend

In terms of the increase, we expect our Wearables devices to be the primary driver of Reality Labs operating losses growing in 2025 across both cost revenue and operating expenses. And that really comes from our efforts to further accelerate the adoption of our AI glasses products

— Susan Li, Meta CFO on Q4’24 follow up earnings call

Wearables

On Wearables we found that Meta has sold 1 million Meta Ray-Bans in 2024, (which was a pleasant surprise for the company) and this will be a decisive year for the wearables category:

Our Ray-Ban Meta AI glasses are a real hit, and this will be the year when we understand the trajectory for AI glasses as a category. Many breakout products in the history of consumer electronics have sold 5-10 million units in their third generation. This will be a defining year that determines if we're on a path towards many hundreds of millions and eventually billions of AI glasses -- and glasses being the next computing platform like we've been talking about for some time -- or if this is just going to be a longer grind. But it's great overall to see people recognizing that these glasses are the perfect form factor for AI -- as well as just great, stylish glasses

— MZ Q4’24 earnings call

Although at a later employee town hall MZ was a little more conservative:

“…one of the questions for us is, are we going to go from 1 million this year to 2 million? Are we going to go from 1 million to 5 million?”

— MZ Town Hall - Jan 31, 2025

As a reminder a pair of glasses are currently priced at $300 (A$480/£240/€290). So each incremental million devices sold is about $300 million (less than 0.2% of META revenue). However, I think the wearables category is a very interesting foundational step for consumer, and enterprise AI adoption (more on this later).

Given the green light, the Reality Labs team are not holding back with 2 super bowl commercials, with A grade stars, out already. As a reminder showing the ad during the super bowl is between $4m-10m per 30 second slot, with the commercial including talent at this level was likely another $7m-$12m. Given the internal ad inventory being given to the team this is just more ammo being fired off.

This marketing investment is going into a slightly stylized version of the current model. There is a swirl of rumors that Meta has a new series with an in built display. From the FT:

Meta plans to add displays to its Ray-Ban smart glasses as soon as next year, as the US tech giant accelerates its plans to build lightweight headsets that can usurp the smartphone as consumers’ main computing device. The $1.5tn social media group is planning to add a screen inside the $300 sunglasses it makes and sells in partnership with eyewear group EssilorLuxottica, according to people familiar with the plans. The updated Ray-Bans could be released as early as the second half of 2025, the people said. The small display would be likely to be used to show notifications or responses from Meta’s virtual assistant.

Meta did not demo them at CES this year but multiple other companies did show off their own versions. Multiple people who saw the tech said it was far from prime time ready.

In any case, I believe that the Meta Ray-Bans and the rumored Oatley’s targeting athletes will need to sell at least 5 million for MZ to continue to support the product. The audio, design and ease of taking photos and videos is recognized, but the use cases are sufficiently narrow that they haven’t gone beyond the “Innovator” segment of the market. Llama 4 and a tight integration with the glasses will be essential in the search for the “killer use case” that sparks joy.

Metaverse

The Metaverse, primarily the Quest line (~$500 retail price) including the Quest Pro (~$1,500), are focused on software this year with the Quest 3S launched in October 20244. MZ talked about improving graphics on the earnings call:

This is also going to be a pivotal year for the metaverse. The number of people using Quest and Horizon has been steadily growing -- and this is the year when a number of the long-term investments that we've been working on that will make the metaverse more visually stunning and inspiring will really start to land. So I think we’re going to know a lot more about Horizon's trajectory by the end of this year.

— MZ on Q4’24 earnings call

2024 had a number of foundational OS feature releases around connecting Quests with Windows via Remote Desktop, and improvements in 2d/3d multitasking. But now in 2025 they need apps that make use of those features combined.

We’ll see what the year brings on this front, but success IMO will be a change in the Metaverse narrative towards excitement from the 3rd party developer community.

“Set yourself on fire”

Andrew Bosworth, the CTO of Meta and the main champion for Reality Labs, told the world that 2025 was a crucial year for RL in his 2024 review letter:

This has been the lesson time and again over the last decade at Reality Labs. The most important thing you can do when you’re trying to invent the future is to ship things and learn from how real people use them. They won’t always be immediate smash hits, but they’ll always teach you something. And when you land on things that really hit the mark, like mixed reality on Quest 3 or AI on glasses, that’s when you put your foot on the gas. This is what will make 2025 such a special year: With the right devices on the market, people experiencing them for the first time, and developers discovering all the opportunities ahead, it’s time to accelerate.

On February 3rd, he wrote an emotive call to action memo for the Reality Labs team:

On paper 2024 was our most successful year to date but we aren't sitting around celebrating because know it isn't enough. We haven't actually made a dent in the world yet. The prize for good work is the opportunity to do great work.

Greatness is our opportunity. We live in an incredible time of technological achievement and have placed ourselves at the center of it with our investments. There is a very good chance most of us will never get a chance like this again.

He ends it with an interesting quote

I will close with an Arnold Glasow quote: "Success isn't a result of spontaneous combustion. You must set yourself on fire." 2025 is the year. Let's be on fire.

All the Servers: Capex Increases

Just before the Q4’24 earnings call MZ declared capex for 2025 would be $60 billion to $65 billion implying a ~45%-50% annual growth rate between 2023 and 2025.

In terms of servers this split across 3 areas “Core Non-AI” such as CPU and network equipment for video streaming, “Core AI” which is about driving their ranking and ad systems, and Gen AI i.e. Llama.

Core AI

Susan Li called out that the majority was for the Core business:

On the data center side, we’re anticipating higher data center spend in 2025 to be driven by build-outs of our large training clusters and our higher power density data centers that are entering the core construction phase. We’re expecting to use that capacity primarily for core AI and non-AI use cases. On the networking side, we expect networking spend to grow in ‘25 as we build higher-capacity networks to accommodate the growth in non-AI and core AI- related traffic along with our large Gen AI training clusters. We’re also investing in fiber to handle future cross-region training traffic. And then in terms of the breakdown for core versus Gen AI use cases, we’re expecting total infrastructure spend within each of Gen AI, non-AI and core AI to increase in ‘25 with the majority of our CapEx directed to our core business with some caveat that that is -- that’s not easy to measure perfectly as the data centers we’re building can support AI or non-AI workloads and the GPU-based servers we procure for gen AI can be repurposed for core AI use cases

Core AI delivering the content ranking system, and ad system ranker have been delivering results. I quote a large section below on engagement as I think it shows how lessons in LLMs is spreading to other parts of AI:

Next, let me talk more about our multi-year roadmap for recommendations. Previously, we operated separate ranking and recommendation systems for each of our products because we found that performance did not scale if we expanded the model size and compute power beyond a certain point. However, inspired by the scaling laws we were observing with large language models, last year we developed new ranking model architectures capable of learning more effectively from significantly larger data sets. To start, we have been deploying these new architectures to our Facebook video ranking models, which has enabled us to deliver more relevant recommendations and unlock meaningful gains in watch time. Now, we’re exploring whether these new models can unlock similar improvements to recommendations on other surfaces. After that, we will look to introduce cross-surface data to these models so our systems can learn from what is interesting to someone on one surface of our apps and use it to improve their recommendations on another. This will take time to execute, and there are other explorations that we will pursue in parallel. However, over time we are optimistic that this will unlock more relevant recommendations while also leading to higher engineering efficiency as we operate a smaller number of recommendation models.

— MZ Q3’24 earnings call

Which we get directional quantification on last quarter:

On the first, daily actives continue to grow across Facebook, Instagram and WhatsApp year-over-year, both globally and in the United States. In Q4, global video time grew at double digit percentages year-over-year on Instagram, and we’re seeing particular strength in the US on Facebook, where video time spent was also up double digit rates year-over-year. We see continued opportunities to drive video growth in 2025 through ongoing optimizations to our ranking systems. We’re also making several product bets that are focused on setting up our platforms for longer-term success.

— Susan Li - Q4’24 earnings call

Meta has previously communicated that video watching is 50% of engagement time, and that 2024 Family of Apps revenue was ~$160 billion; it is therefore reasonable to assume that Meta is seeing a multi-billion return on “Core AI” investments.

Core AI: Advantage+ Creative

Meta Andromeda is the machine learning approach to selecting which ad to show a person. Historically this has been done using a series of heuristics i.e. algo rules programmed and parameterized manually. The process is moving more and more to a machine learning approach.

In and of itself, the improvements are noticeable but minor e.g. +8% ad quality. The real value comes when we mix in Advantage+ Creative which can produce multiple variations on the same creative concept.

Instead of having 1, 2 or 3 forms of creative for a campaign Advantage+ Creative can increase this by an order of magnitude (it can actually go higher, but there is decreasing marginal benefits beyond 50 variations). Think of an ad with someone drinking a Pepsi, now imagine that the person shown changes based on what is known about the user seeing the ad.

Meta Andromeda is not only about choosing which product or campaign to show a user, but which version of the ad. Going back to our example, maybe people prefer people who look like themselves, maybe not.

Overall, Meta is claiming a 22% increase in return on advertising spend from Generative creative, with Meta Andromeda promising a multiplier on top of that improvement, especially as more businesses decide to enable generative creative.

Core Non-AI

Core Non-AI is just the cost of infrastructure to handle current services like video streaming, voice calls etc.

A quick item of interest however, is the “W” cable (not the official name) that will cross the globe to support Meta’s usage which drives “for 10% of all fixed and 22% of all mobile traffic”. This is a $2 billion investment with the potential to grow to $10 billion. Meta owns

Some have pointed out that the cable is less exposed to the Red Sea, the South China Sea, and the the Strait of Malacca. All geopolitical stress points.

Gen AI

Meta AI i.e. using an LLM within one of Meta’s products is now up to 700 MAU. Llama 3.1 is no longer in the top 20 of chat models according to huggingface.

This speaks to the power of Meta’s distribution advantage, with many speculating that the engagement levels are extremely weak relatively to model leaders.

Having said that Meta’s AI Studio where people can create AI characters to interact with, or extensions of person to answer fans is a clear use case that is showing traction on other platforms, also here.

More broadly, the case for customer support via WhatsApp is clear especially where WhatsApp, and Facebook Messenger, is the default messaging tool. Clara Shih the ex-CEO of Salesforce AI has been brought on to lead this effort5. Messaging is a $2bn ARR business growing ~55% a year and is primarily outside of the US i.e. there is ample room to accelerate growth.

It is interesting to note that while Amazon, Microsoft, and Salesforce are focused on enterprise clients; OpenAI, Perplexity, Meta and Google are aiming at consumers. Where is SMB? Honestly, I think Meta is actually in one of the best positions for this space even ahead of the likes of HubSpot.

Finally - and perhaps most importantly - while Google, Microsoft, and Amazon are ramping up capacity to sell to 3rd parties, Meta is 100% self contained, with the tightest feedback loop on value creation.

The issue of the moment is that MZ has reminded us that the playbook is product, scale, and then monetization in that sequential order.

So I think it’s just in general, there’s a lot to build and be excited about. I guess my note of caution or just my kind of periodic reminder on our product development process, if you will, is we build these products. We try to scale them to reach usually a billion people or more. And it’s at that point once they’re at scale that we really start focusing on monetization. So sometimes we’ll experiment with monetization before, we’re running some experiments with Threads now for example.

But we typically don’t really ramp these things up or see them as meaningfully contributing to the business until we reach quite a big scale. So the thing that I think is going to be meaningful this year is the kind of getting of the AI products to scale. Last year was sort of the introduction and starting to get it to be used. This year my kind of expectation and hope is that we will be at a sufficient scale and have sufficient kind of flywheel of people using it and improvement from that that this will have a durable advantage.

But that doesn’t mean that it’s going to be a major contributor to the business this year. This year, the improvements to the business are going to be taking the AI methods and applying them to advertising and recommendations and feeds and things like that.

So the actual business opportunity for Meta AI and AI Studio and business agents and people interacting with these AIs remains outside of ‘25 for the most part. And I think that’s an important thing for us to communicate and for people to internalize as you’re thinking about our prospects here.

But nonetheless, we’ve run a process like this many times. We built a product. We make it good. We scale it to be large. We build out the business around it. That’s what we do. I’m very optimistic. But it’s going to take some time.

— MZ Q4’24 Earnings Call

Operating Expenses: The CTO team Grows

The expense guide of 2025 is $114bn -$119 bn, a 22% increase at the midpoint or $21 billion.

Now an estimated $5 billion of this will be depreciation from previous years, but that would still require Meta to find a way to spend an incremental $16 billion. The last time Meta found a way to deploy an incremental $16 billion+ was during the COVID extravaganza, wherein they spent an incremental $18bn and $16bn respectively in 2021 and 2022. After the pain in the immediate aftermath, one would hope that management had learned, but here we are.

Historically, management has undershot its own expense guide. The street is taking that bet estimating total expenses come in at around $113 bn, or in other words excluding the depreciation expense the incremental operating expense will be ~$13bn. Management has guided that the losses in Reality Labs will continue to grow at the 2024 pace i.e. another ~$2bn. So that leaves $11bn incremental into the Family of Apps business.

Management has communicated that the majority will be for data center operations and growing the technical team. However, Meta is also applying a more aggressive performance management plan cutting 5% of staff (about 3,700) through performance based terminations delivered by the end of February.

Trying to move people out, replacing them, and growing the team simultaneously is a tough ask on middle management and the HR departments. I expect this will drive Meta’s headcount expectations to be weighted towards the back half. Combining this with the impact of slowing the pace of infrastructure deployment, I expect expenses to come in even lower than street expectations.

Final takeaways

The core of the business will have some give and take in terms of user engagement, and better monetization. Obviously, give it is the majority of the value but to me it isn’t where I’ll be watching most carefully. My 3 key issues are:

Reality Labs finally needs to put some wins on the board or the investment levels will need to be moderated. If neither happen, I expect a re-rating to flow through. I don’t think we’ll have answer here until the Q3’25 earnings call and Christmas products are released.

Gen AI use cases to be more prominent and start to gain traction/engagement beyond the 700 MAU figures touted to give some sense of how we’ll monetize the Gen AI capex. Again, outside of Llama 4 performance, I don’t think we’ll see this until H2.

Wildcard will be TikTok USA saga conclusion. While a sale is definitely on the cards, polymarket thinks there is a decent chance of it getting announced in May, there is a small chance we end up back in a “black out” period.

There were 64 or 65 national elections depending on how you count it in 2024

Reality Labs increased its operating losses by $1.7 billion in 2024

Launch of a Quest 4 is not expected until 2027 and Bloomberg reporting that it will be goggles rather than the current headset form factor.

Appropriate given her authorship of “The Facebook Era: Tapping Online Social Networks to Build Better Products, Reach new audicences, and Sell More Stuff”